Investor fears over the United Kingdoms continued membership of the European Union has also increased the negative pressure on the Pound. The Brexit referendum is now looming large on the horizon. Only an overwhelming endorsement by the UK electorate for continued membership of the Union will ease the pressure on Stirling.

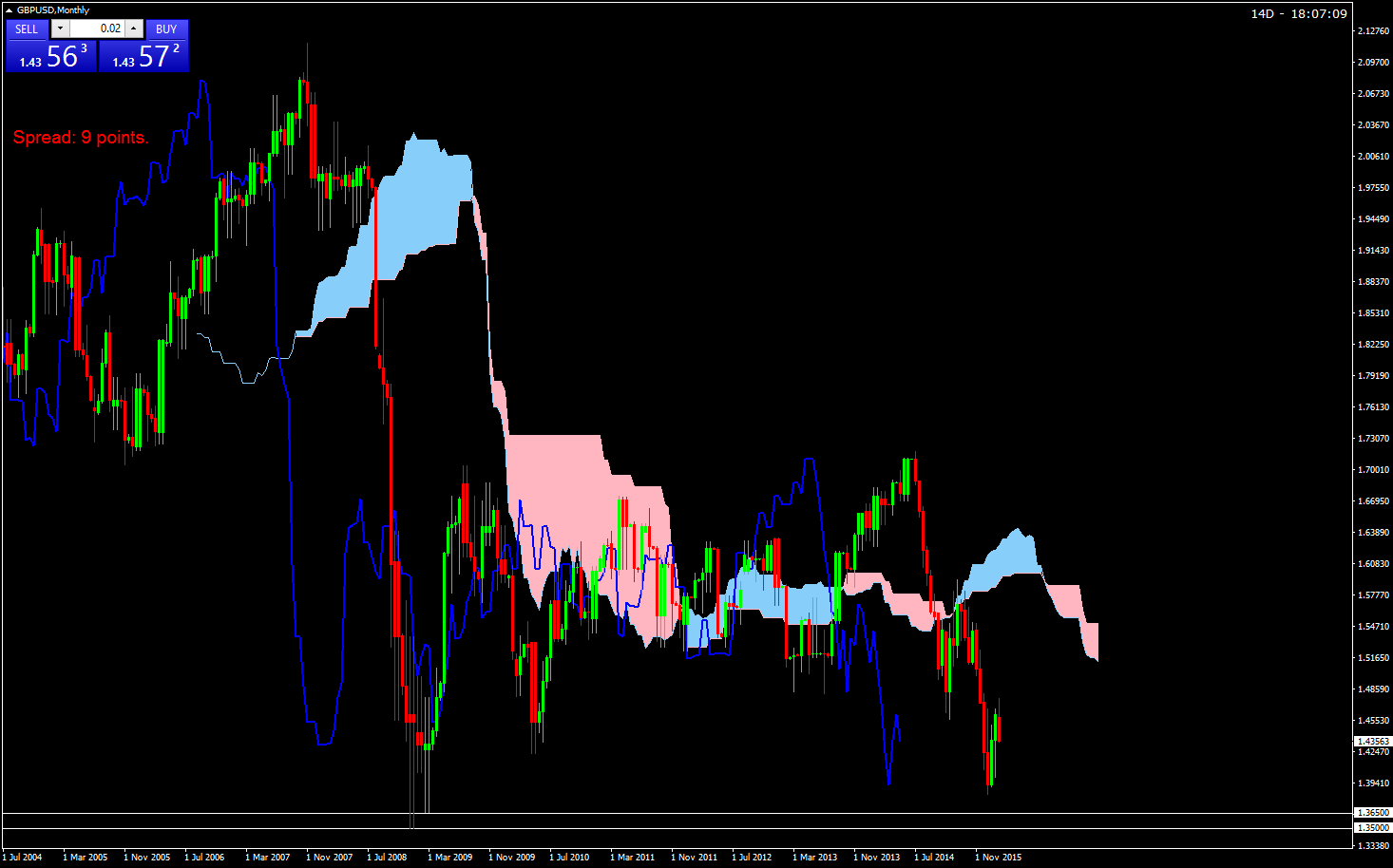

From a technical viewpoint, the negative GBPUSD sentiment can be seen by the current monthly Ichimoku chart setup.

GBPUSD is trading under the cloud. The next levels of significant support being found at the 1.3650 and the 1.3500 areas.

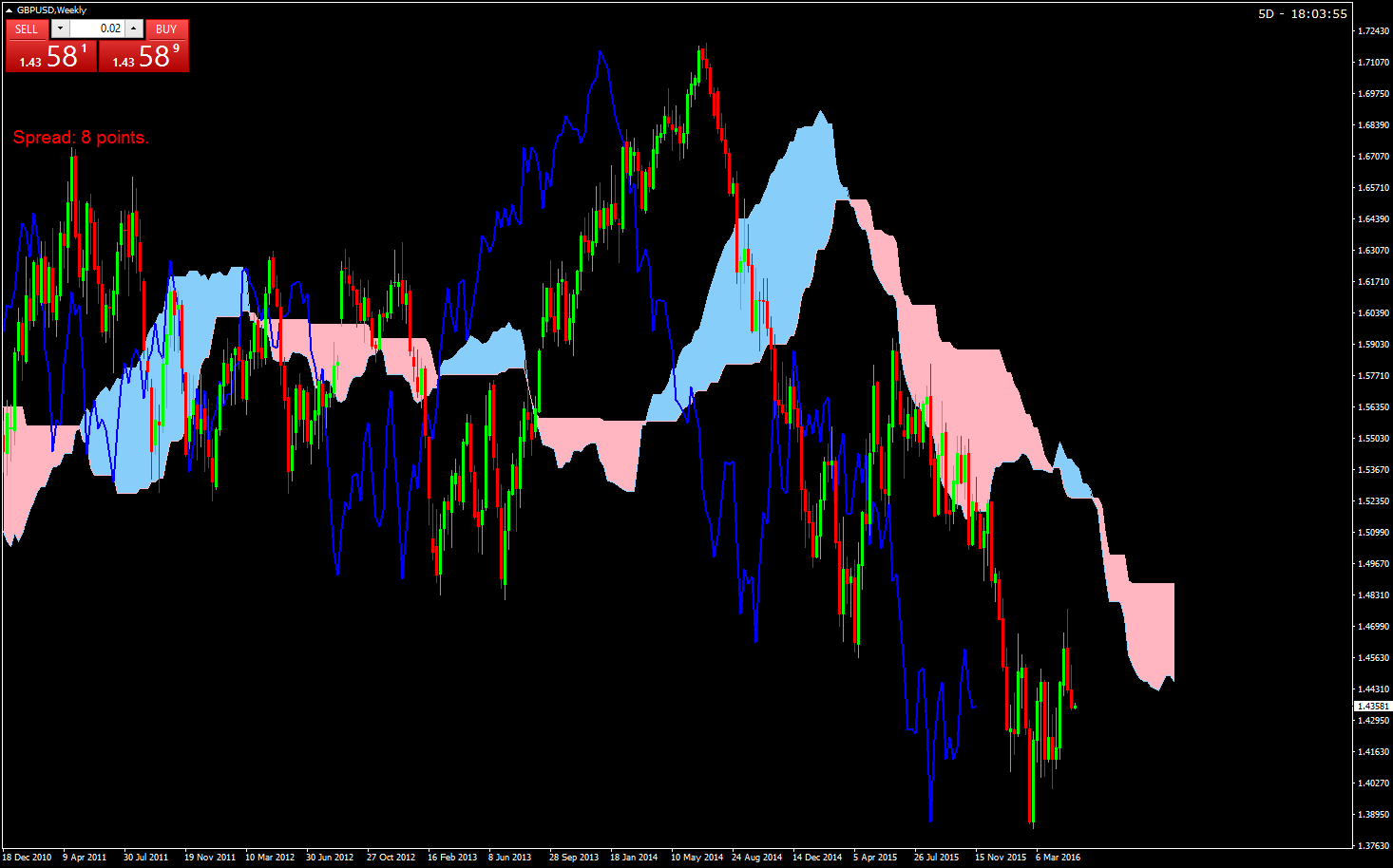

The weekly time frame only reinforces the negative GBPUSD view as it can be seen that sellers push the Pound lower when it attempted to trade through strong resistance that can be found in the area of the cloud.

The daily timeframe, however, does look bullish with Pound trading higher following its upside break off an inverse head and shoulders pattern. Furthermore, GBPUSD is now trading above its daily cloud.

As the daily time frame is not in gear with the weekly and monthly time frames, the current course of action is to take long signals off the hourly and 4 hour time frames.